Not every startup is able to bootstrap or take out a large loan, but regardless of their individual circumstances, John Wright thinks they should seek out investors anyway. Here he provides some unvarnished advice for those weighing their fundraising options

“Hey John, we are in. Send an offer after the weekend.”

I saw this text come in on Facebook Messenger and even though I knew I was sending a pitch, I was expecting to hear ‘not for me’.

That was the halfway point in my six-month process of looking for investors. I was pumped to get that text and surprised too because it hadn’t been one of my normal pitches. I was in full-on hustle mode and prepared to pitch almost anyone.

At this point I already had $150k in offers so this put me in the territory I was looking for. Shortly after that my offers went from $250k to $650k which was way over my $400k target. Among them were offers where the investor wanted a better equity stake.

I never thought I would be rejecting money at all but that is exactly what happened. I wanted a balance of investors, I didn’t want one that was too dominant or influential. Numerous people had given me that advice, people who were genuine and interested in helping and mentoring me without getting anything in return. Well, some of them were interested in investing but they coached me and looked after me first and gave me insights on what to look for and expect when dealing with investors.

By the time this article is published, we could be in a different position. I’m writing this in mid-August and we are sitting at $225k, or just over 50% of our $400k target. If that is all we get, then fine. It’s more than enough money for us to go because we already have recurring and growing revenues.

Of course, things can change at any moment, such as investors pulling out, markets shifting, our needs shifting, new opportunities arriving, you name it.

Should you raise capital?

Not everyone can bootstrap their business and not everyone can just take out a large loan for their operation. Regardless of the situation the question is still the same: should you seek out investors?

I’m going to say yes regardless of your situation. Why? Here are my three reasons on why you should at least go about the process of raising capital whether you proceed with it or not.

- Validate your ideas

- Expand your network

- Grow your business skills

Validate your ideas

Investors can help you validate your business idea in one of two ways. First, they will ask you to validate it by explaining it and proving it as best as possible. You can do this with proof of concept and having some sales. Or if you’ve done a good enough job of proving your idea will work, the fact they would invest in you could validate the idea. We are assuming that the investor does not fall into the FFF category. You know, Friends, Family and Fools.

You have to assume that some investors and VCs are professionals with a proven track record, people who know when an opportunity is worth the risk and investment. For them to say yes to your project is all the validation you need, even if you are a seed-stage startup.

Expand your network

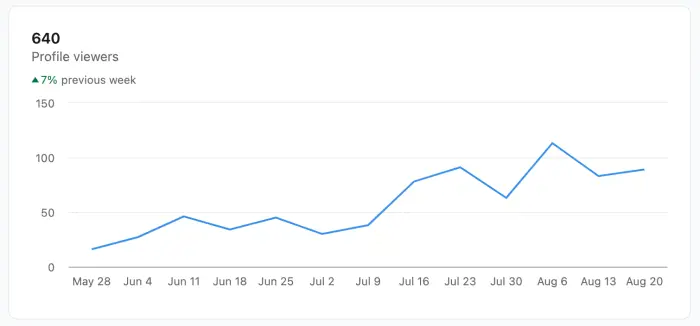

I thought I had a very good network when I started this journey. I still do, but six months later I’ve gained a lot of new connections that I don’t know would have happened had I not put myself out there.

Don’t be afraid to put yourself out there. Much like an employer wants to see initiative from a job seeker, an investor is going to want to see the same drive in you. You have a network, so simply ask around if anyone knows of some investors. You’d be surprised at some of the people that are active investors. I’ll share a few more tips on this on LinkedIn.

Last but not least, some of the investor connections have led to introductions to new business!

Grow your business skills

I can’t recall a time in my life in the past 20 years where I levelled up my skillset in such a profound way. They say you can’t just go to a school for entrepreneurship. Trying to navigate the world of investors and venture capital is something else. Not only did I sharpen my skills, it had a positive effect on our entire team.

Video vs pitch deck

In the beginning there was a pitch deck. You send out your emails, LinkedIn messages, WhatsApps, texts and get a low response rate. Amazing! All that work for nothing.

Pitch deck burnout

As a designer, I love my pitch deck. I put a lot of time into it and read articles on creating the perfect deck. I consumed everything I could read from David Beckett and had it ripped apart by angel investors and mentors. All I needed to do was get this in the hands of potential investors and see what happens.

The reply rate wasn’t that stellar and I got a few replies that said not interested.

Time for video

This year I made a conscious effort to start producing videos for StatsDrone. It was a fear I had in starting especially when it comes to sharing anything on YouTube. I had my own fears and insecurities about doing this but I gave myself two good reasons why I wanted to do video.

- Anybody I see making videos seems to be successful

- I wanted to document aspects of my journey, like a time capsule

My first video was rubbish but at some point I had to stop worrying about having a perfectly scripted video. A completed video is better than a perfect one.

Video pitch: let’s book a call

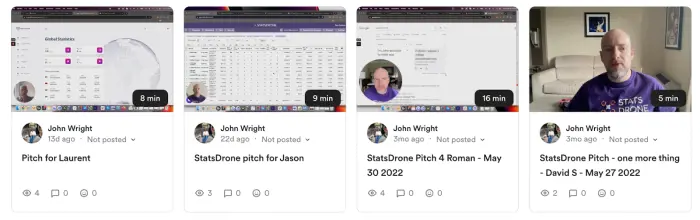

With my new video skills and confidence in making videos, I now started to try video pitches. I’d record myself using Loom where I had my face on video on top of my screen showing my software as a demo.

I’m not measuring my conversion and success rate but I know that video was an absolute game changer. I was getting replies asking to book a call.

Best of all, I would send out my videos and I could see when the videos were watched and how many times they were viewed. I had great success using Loom and I started to do more work with Telloe.com which is a more B2B-focused video service.

Where to find the right investors

Seek mentors and advisors Mentors can be found almost anywhere but be sure to be respectful of someone’s time. Seek out people that either don’t want anything in return or will simply give you honest advice that puts you first. There are too many people offering advice that benefits them at your expense. Others will give advice but in return will expect a fee or equity. As much as I think this is fair, the best advice I’ve received is from people who are genuinely interested in helping and don’t want or need any compensation.

In my experience, LinkedIn is by far the best place to network.

When you see a conference happening, you can search to see who is attending. Look up their profiles and you’re going to find potential customers and investors. Once you’ve got your free list of attendees, send them a message!

Getting good at any social media site takes time and dedication. You are a brand as much as your company is, so do some personal branding. Your efforts here will definitely keep you in front of investors, especially if you have already pitched them in the past.

My best tips and advice for founders seeking investors

- Pitch investors that are not your top targets first. Make the mistakes with them and you’ll be a polished pitch machine by the time you hit your preferred investors.

- Start the legal process early and get your docs in order. When someone commits to invest, don’t delay – get the paperwork signed and the cheques cashed. If you delay, people can back out.

- Focus on your network and industry: all my pitches fell on deaf ears when I contacted VCs and investors outside of my industry. Besides, they would rather see some commitment from people in your industry to validate your idea.

If you are a founder and looking for advice, email me john@statsdrone.com. There is a good chance I’ve experienced a challenge that you are facing right now.

John Wright

is the CEO and co-founder of StatsDrone, which makes software for affiliate marketers and programmes. John has been in the igaming space and in affiliate marketing for over 20 years

Image by Mohamed Hassan from Pixabay