Three months on from his article on raising money as a startup, John Wright is back with an update on seeking investors. This time he provides a deep dive on pitching.

I am eight months into my journey of looking for investors for my startup and only recently hit me that maybe you never stop raising. That is if you look at a lot of tech companies that have the potential to grow and scale, there are always future rounds.

It is now that I reflect back on the questions asking if we will have a future round that I realise this is more of a test question. The test is, have I thought this through and what do those investors on the other side know?

Six pitches in one week

I am writing this on a Friday night recapping a week where I did six pitches to investors. I’m happy to say that all the pitches went extremely well and I’m feeling confident I’ll be able to close our round. Of course, there is no celebrating until the money is in the bank.

I probably have enough investor leads at this point but I still have two investor calls next Monday and I’ll be in Toronto later that week to meet up with five other investors.

Leading up to this point, I had put a lot of time into learning sales, reworking my pitch deck and presentation as well as putting my networking into overdrive.

Finding those investors

Here is what I’d do differently if I had to start this process all over. I want this to be a quick set of tips for any other founders looking to raise capital.

- Take a course on sales and negotiation

- Find a pitch coach

- Perfect that presentation

One thing I did well last year was network and attend as many conferences as I could. This goes hand in hand with networking. I attended at least eight significant conferences including numerous virtual summits.

Conferences are a chance to set up meetings in advance but also a chance of meeting new people. If you are not a social butterfly, then the best thing I can give you as a tip is to figure out a way to gamify networking and turn it into a game.

Investor meetings in person are best. I’ll talk more about how I think you can meet more investors.

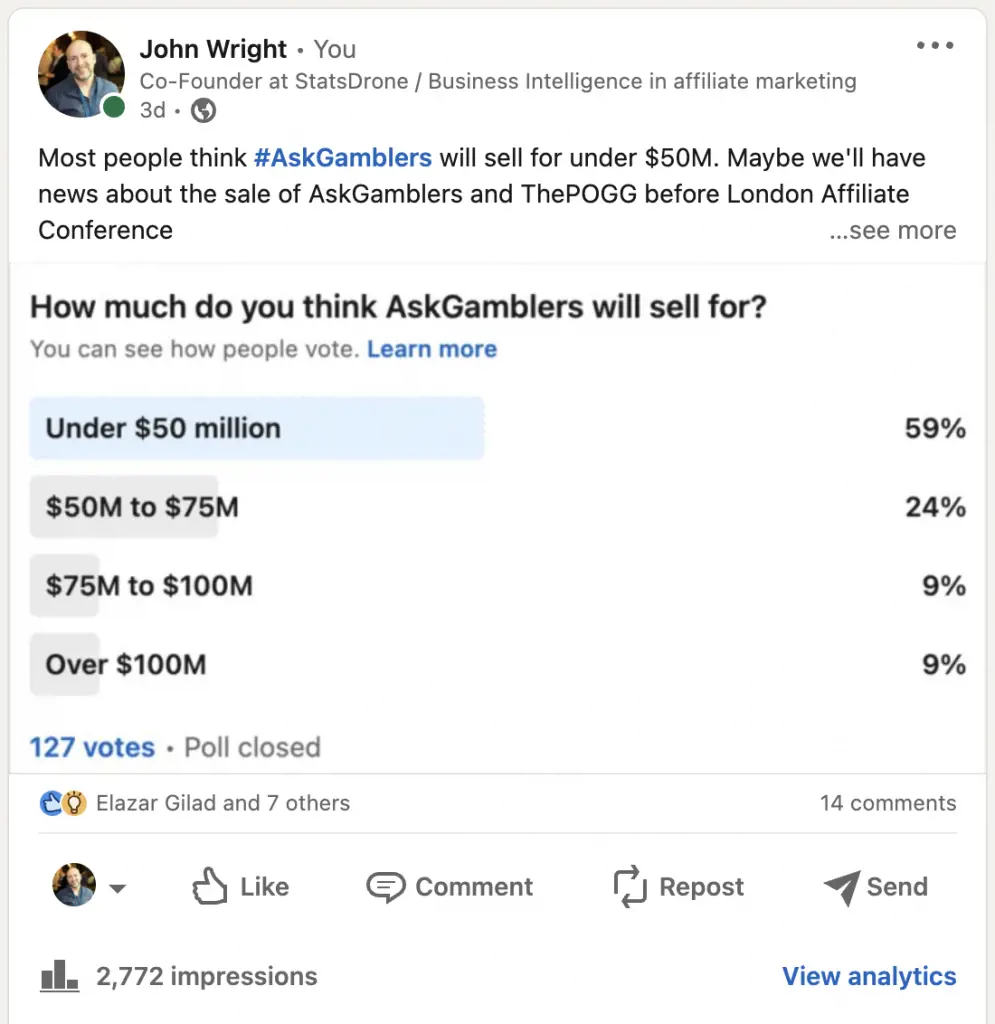

I will share a short story that highlights the power of social media. My friend Duncan from ThePOGG was selling his site which happens to be a competitor to AskGamblers. AskGamblers had done some press releases announcing their intent to sell. This was perfect timing to capitalise on the buzz, so I created a poll that I had hoped for 10 to 20 responses.

My LinkedIn lit up with 129 votes on that poll of what people thought AskGamblers was going to sell for.

The amazing benefit of this is that people that have ignored my messages for 6 months, were now reaching out to me to chat!

You don’t get what you don’t ask for

Have you asked your entire network if they invest or at least if they know of investors?

By simply asking my contacts, I’ve been able to open doors that I didn’t even know were right in front of me. I was actually surprised at how many people are already investors and the same goes for companies that have venture arms. Some of my requests have led to introductions. Don’t just assume your friends are going to do the intros for you, go ask them if they can help.

Learning to negotiate

I knew I had to sell the opportunity of investing in my company. So I didn’t know if I should focus on learning to sell or learning to negotiate. I’ve read my fair share of sales books and one of my sales mentors, Sean Conrad suggested I listen to his go-to book for learning sales. That book is called Never Split the Difference: Negotiating as if Your Life Depended on It, by Chris Voss.

I wish I had read his book 8 months ago when I started this journey. It taught me a lot about what I needed to do when it came to both sales and negotiation. I can now look back at the mistakes I made and there was information right there that I wasn’t getting.

The counterfeit yes

I did however get the dreaded ‘Counterfeit Yes’. I had one investor that said they were committed when they really were not. Now I can be mad about this all I want but I had to have a hard look in the mirror to understand the situation. The truth is, I delivered a dud of a presentation to this person, and I don’t think they wanted to disappoint me or perhaps were worried about breaking my spirit.

It wasn’t a month after this situation that I realised this was indeed a ‘Counterfeit Yes’ and that my actual presentation was the reason for it.

Pitch coach

I was fortunate enough to meet a pitch coach and get some help in perfecting my pitch deck and the pitch itself. Look up “Benjamin Peleg” on LinkedIn who helps start-ups perfect their pitch. I started working with him in early December and right away he fixed some major issues on my deck as well as helped me with the pitch presentation too.

I had put in a lot of time working on my new pitch deck over the fall. I knew there wasn’t something quite right about it as it had too many words, too much information, too abstract of slides and no elements of a story. I incorporated my story into the presentation, but I knew there was more to unlock.

After just 1 session with Ben, I would highly recommend every startup get a pitch coach. If you don’t think you need a pitch coach, you probably do.

Telling a story

My pitch deck and the presentation itself were missing a story. I had the deck rebuilt which didn’t feature the story, but I knew my presentation had to have the story as the key element. I had spent days writing the entire script of the presentation. The script itself was 1300 words which was a lot but I needed to fill it out and learn to shorten and simplify it.

The presentation

Armed with my new deck and the new script, I literally spent an entire weekend practising the new presentation. I knew the effort had paid off when I re-pitched previous investors that haven’t come on board. The new feedback proved the effort was worth it.

Pitch everyone

I read a story that Jeff Bezos had to take 60 meetings which yielded 22 investors at $50k each. It is your job to make those 38 rejections to regret not taking your offer and opportunity. Every single one is an opportunity until they say no.

For those that are on the fence and not sure if they should pursue their ideas and their dreams. My biggest fear was not starting any of this journey and regretting it later on in life. I can tell you right now this is the best business course you will take that only costs you time and perhaps a little bit of sanity.

Closing comments: mentors are everywhere. Go seek them out.

John Wright

is the CEO and co-founder of StatsDrone, which makes software for affiliate marketers and programmes. John has been in the igaming space and in affiliate marketing for over 20 years