As a marketing manager at Betfair during the financial crisis of 2008, Nick Garner has worked through one global crisis – and come out the other end. Here he gives his view on what could transpire this time round

As I write this article, the world is going crazy. Markets are crashing, people are dying and nearly everyone is getting stressed. On a personal level, I have vulnerable, elderly loved ones and I’ve been making plans for them. In an attempt to stay rational amid all this insanity, I’ve spent days reasearching the baseline facts. Based on the results of my research, I have made critical life or death decisions to protect my family and loved ones. In this article, I will combine some of my: ● Understanding of the Covid-19 pandemic. ● 14 years’ experience in igaming. ● Research into the 2008 financial crash and 1918 flu pandemic. I’ve done my best to research everything comprehensively, though given the speed with which things are moving some of the numbers may be marginally inaccurate.

PLAN FOR THE WORST AND EVERYTHING ELSE IS A BONUS

When I analyse complex topics, it’s important to have an assessment framework. Typically, I break things down to their most basic elements and build up from there. Here’s what we know:Covid-19

● Life will carry on for most people after the pandemic. ● The internet will also carry on working. ● Worst-case scenario: 60-80% of the world’s population will contract this virus in the next 12 to 14 months. ● 80% of those infected will suffer only a mild to moderate illness. ● Vaccines are being worked on but they are unlikely to come into widespread use until late 2020 or early 2021. ● Mass gatherings are unlikely to occur for several months at least.Gambling

● Circa 50% of all gambling industry revenues come from sports and race betting (source: H2 Gambling Capital). ● Any business with a large retail presence will see a catastrophic loss of customers until at least October 2020 due to social distancing. ● The biggest global gambling operators are generally the most vulnerable because of their retail presence. ● Countries such as Great Britain, Sweden and the US already put huge pressure on gambling operators with tax take and compliance. (The industry is already under stress.) ● Governments never lose votes by being tough on gambling. (Excessive gambling is bad for society.) ● Regulators are comfortable punishing non-compliant operators. (Witness Betway’s recent £11.6m settlement.) ● Only 6% of online gamblers are over 65, according to GB Gambling Commission data.Psychology

● In times of stress people resort to living in hope. In the 2008 recession, we saw an increased spend on lottery tickets. ● Several research papers prove the correlation between boredom and the desire to gamble. Whole populations will be in lockdown. Boredom is inevitable. These are the ingredients, then.SEISMIC CHANGES

I’ve spent a fair amount of time reading through the annual reports of some of the larger operators. All of them include various risk assessments. I haven’t yet seen anything about a global pandemic. Covid-19 has blindsided everyone. In January 2020 you would have assumed the great industry monoliths such as William Hill or Ladbrokes Coral would carry on consolidating their grip of the market. My reasoning? Large businesses can absorb the cost of regulation far more easily than smaller operators. As each country gets regulated, it has its own local legislation. And every year, regulators get more and more aggressive with operators. Only the biggest businesses can survive in heavily regulated, low-margin industries. But that could all change. For example, in the UK there are about 9,000 betting shops. William Hill has 2,300, Ladbrokes Coral has 4,000 and Betfred has 1,550. In the US there are some 460 offline casinos. They will all have one thing in common: no customers walking into their retail premises. And ongoing fixed overheads which must be paid. Add up the basic facts for offline gambling: ● This pandemic will not ease off for at least a year. ● Governments never lose votes by being tough on gambling. ● Governments will do whatever they can to slow the speed of contagion, such as banning people from unnecessary activities such as… retail gambling.WHAT’S LIKELY TO HAPPEN?

All retail operators were hit with the £2 maximum fixed odds betting terminal restriction. This led to William Hill declaring that 38% of its retail estate (i.e. 900 of their 2,300 betting shops) was no longer profitable. This led to a £882m write-down and a net loss of £721.9m for 2018.£m Write-down680.7 Intangible assets – goodwill 151.5 Intangible assets – licence value 38.6 Land and buildings 12.0 Fixtures, fittings and equipment882.8 TotalFor context, the FOBT ‘shock’ was tiny compared to what’s coming: ● A possible 80% fall in sports betting revenue. ● The closure of every betting shop in the UK and most other countries for a minimum of three months. Based on the ingredients we’ve got, I really wouldn’t be surprised if some of the ‘monolith’ operators dramatically restructure or die.SO WHO WILL COME OUT ON TOP?

Going back to my thesis, look at the foundation facts and build up from there. ● 94% of online gamblers are under 65. So they will be largely unaffected by the effects of the virus. ● The internet will carry on working. ● Online financial transactions are unlikely to be disrupted. ● In stressful situations, people live in hope. ● Boredom will reign because of global social distancing. In a nutshell, the winners will be online gambling businesses that aren’t dependent on sportsbook.FAMILIAR SIGNS FROM 2008?

Some of you long-timers will remember the 2008 crash and its effects on the gambling industry. Back then I was a marketing manager at Betfair. I remember the day of the crash – and that feeling of dread wondering what my future would be. It turned out the gambling industry did okay in the aftermath of the 2008 crash. In the context of online gambling (excluding sportsbook), this is just a repeat of the 2008 shock. In 2017, there was a research paper with the catchy title Economic Recession Affects Gambling Participation But Not Problematic Gambling: Results from a Population-Based Follow-up Study. In the study they talk about some research done in Iceland, a country particularly affected by the 2008 crash. Researchers interviewed 1531 participants about their gambling habits from 2007 through to 2011. The paper stated: “Overall, the findings of the follow-up study suggest that when people are experiencing financial difficulties during economic recessions, the possibility to improve their financial situation by winning large jackpots with low initial stakes becomes more enticing.” Based on my direct experience within Betfair, when times are bad, people gamble in hope.OPPORTUNITY KNOCKS

Some of the big operators are likely to implode because of their retail commitments. The odds are that there will be a huge market vacuum. Online casinos, poker, bingo and lotto sites without too much sportsbook reliance should manage the forthcoming disruption. If these businesses just wait it out, there is a very real chance that a huge vacuum will emerge within the market. For the minority of operators this could be the biggest land grab since 2001 when online gambling first went mainstream. Bad for them, good for you.1918

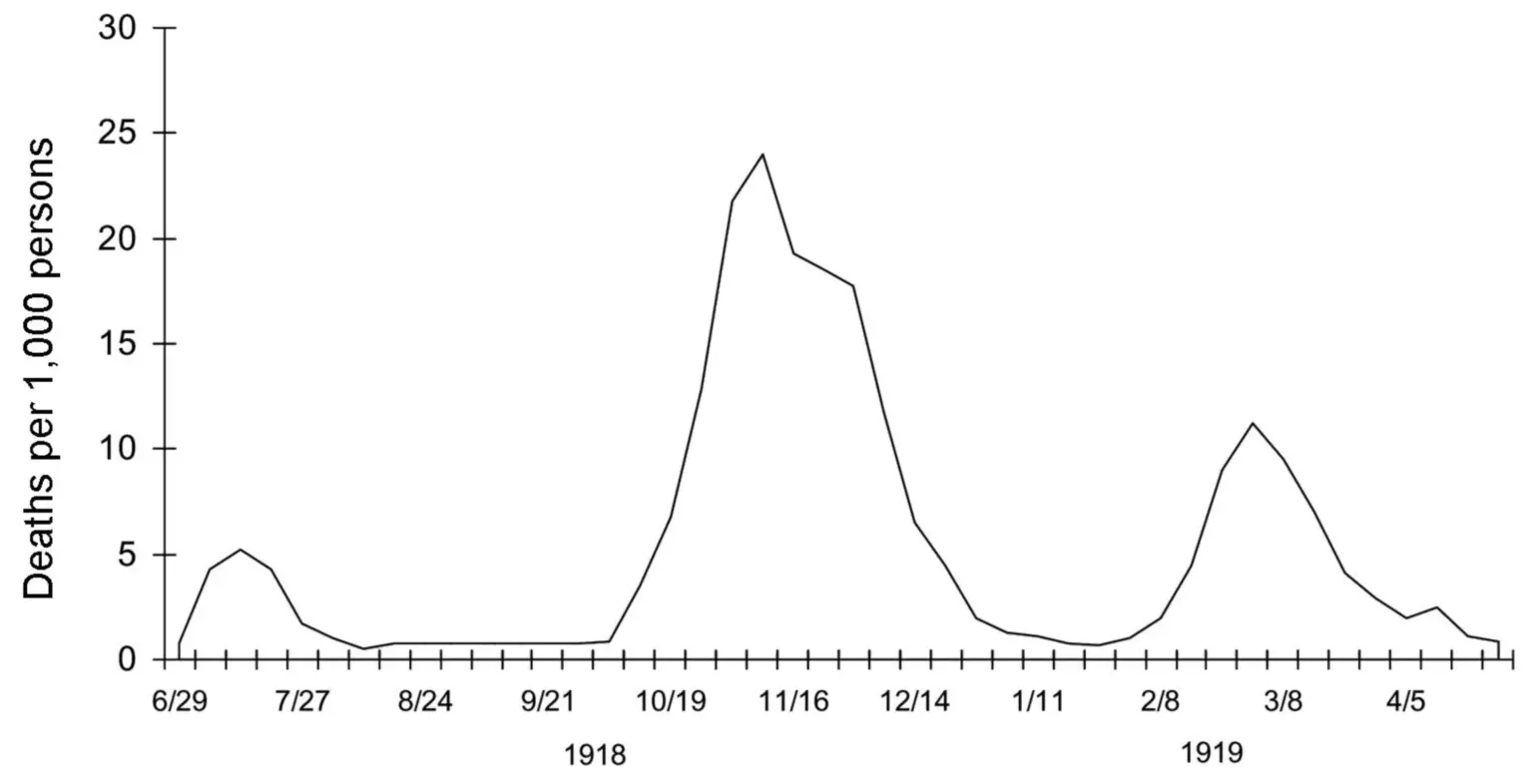

The best comparable event to Covid-19 is the 1918 flu pandemic. You’ll see from Fig 1, it worked through the population in two major waves: