With newly regulated operators knocking at Google’s door to gain account whitelisting for PPC in Sweden, Roy Coughlan maps out the essentials of an effective strategy.

With newly regulated operators knocking at Google’s door to gain account whitelisting for PPC in Sweden, Roy Coughlan maps out the essentials of an effective strategy.

It’s finally happened! After years of deliberation, the Swedish government has liberalised its stance on gambling, regulated the market and opened up a massive opportunity for private entities to offer their products to a territory that loves to gamble. Following in its neighbour Denmark’s footsteps, Sweden has so far issued licences to more than 50 brands, most of which will be busy planning on how best to capitalise.

Until August last year, regulated gambling in Sweden was dominated by the state-owned Svenska Spel and stateinfluenced ATG, with competition coming largely from offshore private entities such as Betsson, LeoVegas, GIG and Mr Green. With only limited options to promote brands online, historically igaming marketing departments have relied on TV and programmatic media buying. But with CPMs varying month by month and TV space difficult to acquire unless strong vendor relations are in place, operators and affiliates have long searched for a medium in which to better control and measure the way they drive brand interest and acquire traffic.

Cue the opening of payper- click advertising, allowing all operators to bid for space on the SERPs. New entrants in Sweden will now get the chance to get their brands visible (see right).

WHAT DOES PPC HAVE TO OFFER NEW BRANDS?

PPC will be seen as a primary channel for new acquisition and the aforementioned companies will all be knocking on Google’s door to gain account whitelisting. Bing Ads will also offer its platform, with a view to gaining market share. PPC is comprised of multiple product types, all of which can be used effectively in the marketing mix.

Products available will be as follows:

1. Google Ads

According to Google research, 6.5% of Swedes say they have interacted with an online gambling site. This means Google SERPs will now have prime real estate available for ads to serve on generic casino, bingo, poker and sports betting search terms. The auction-based system will rank ads that are most relevant to the search query, among other Google signals.

2. App (formerly Universal App Campaigns, or UAC)

Every operator ploughing into Sweden will have an app – and Google offers a product that allows you to promote apps through all of its properties: search, Play Store, YouTube and the Google Display Network. This is also available for iOS (excluding the App Store). These campaigns are simple in their design: just set the budget, agree the cost per install target, add the creative assets and you are good to go!

3. Google Display Network

Google’s syndication programme allows publishers to offer their sites for advertising, and this will give those companies frustrated with being priced out of direct buys an opportunity to curate their own lists of domains and targets based on Google’s audience data. Note this is only for prospecting as Google’s policies do not allow for retargeting.

4. YouTube

It is no secret that TV ad buying for gambling is extremely difficult in Sweden, with securing the right spots at the right time something of a lottery in itself. YouTube products will now offer the customisation of targeting and the ability to control when, where and what they buy to an ever-growing audience. This will allow brands to better measure how their content and creative is working and how it impacts other channels.

BIDDING PRICE AND VOLUME/INTENT

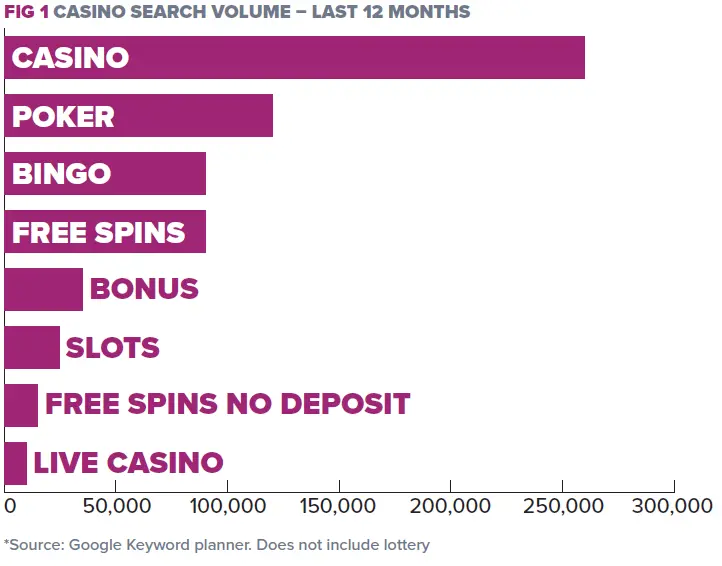

While search volumes are readily available through a number of tools, it is unclear what the average cost per click will be in this market. Coupled with uncertainty around conversion rates, this will make projections difficult. What is clear is the search volume and intent; according to Google, 96% of all search queries in Sweden are brand terms, something that has grown 21% year-on-year. Generic searches sit at 7% as of last year. Fig 1 (below) shows this mapped out over the last 12 months, with casino and poker terms dominating searches.

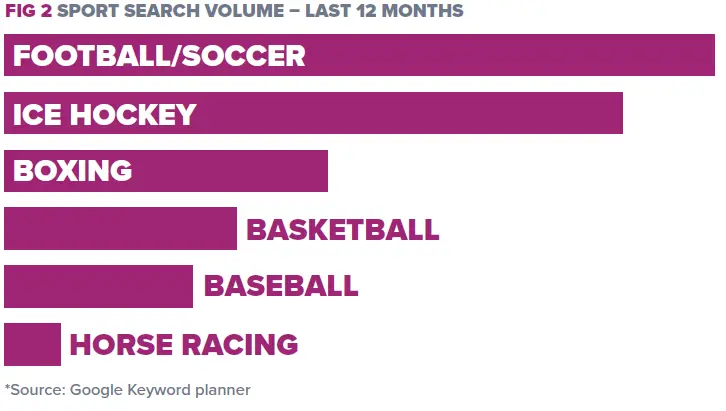

As for sports betting, Fig 2 (below) illustrates the searches made through Google during the same period. We can see that football dominates search volume with ice hockey, Sweden’s second most popular sport, running it close. Meanwhile, combat sports are increasing in popularity with boxing and MMA on the rise.

HOT TIPS IN SETTING UP CAMPAIGNS

Here are some pointers that should be considered when setting up PPC campaigns in Sweden:

1. Consider the seasons

Pay attention to search trends going into the summer months in Sweden. Google Ads is due to launch in spring, so the warmer months will definitely have an effect on user behaviour.

Bearing in mind Sweden has the longest annual leave allowance in Europe, one could assume either a drop-off in appetite for betting or possibly a shift in search volume across devices with volumes likely to increase on mobile. This is especially true in the evenings and after work. With no football tournaments this summer, desire could be further affected, though there is still an outright opportunity in the Swedish football league (the Allsvenskan), which runs from March to November.

In contrast, interest in horse racing will increase during the warmer months with the country’s top 10 races all scheduled to taker place between April and November. Planning a budget for these months should also take into account bespoke sporting events such as heavyweight boxing fights, UFC and other combat sports.

2. Payday cycles

In Sweden, payday or lönedag falls on the 25th of every month, meaning search volume and conversion rates should spike in the two subsequent weekends. Scheduling promotional offers, bonuses and budget around these dates will help drive acquisition and maximise interest.

3. Payment methods

Sweden is fast becoming a cashless society and with this comes alternate payment methods and the use of the electronic identification system, BankID. Promoting the ease and speed of payment will be crucial in defining conversion rates and being competitive in the space.

4. Device behaviour

Much like the rest of Europe, when it comes to placing bets in Sweden, mobile usage is higher than desktop. According to Statista, 29% of active gamblers use mobile phones, while 25% prefer desktop devices. The remainder choose a combination of betting shops, subscription lotteries and betting at race tracks. A review of Google search volume shows that 60% of searches are conducted on mobile devices, something that should be considered not only when developing ad copy but also when managing bids. Cross-device analysis should be regularly reviewed to better understand the user path to conversion and final touch points.

5. Location targeting

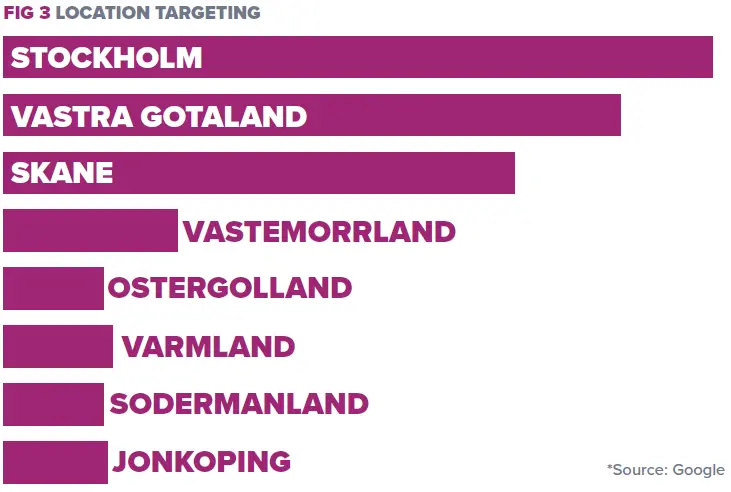

Google query volume shows that the largest volumes of searches are concentrated in three places: Stockholm, Vastra Gotaland and Skane (see Fig 3, below). It’s important to target these with specific bid management. This can help concentrate budget towards areas where demand is greatest. Entering ad auctions in specific territories will also help manage the cost per click, instead of blanket bidding towards the country as a whole.

6. Negative lists

Most advertisers will not have experience with management of search traffic for gambling. Thus the controlling of broad, broad match-modified and phrase match keyword targeting will inevitably lead to the buying of irrelevant search traffic. Having a well structured list of negative terms before launch will help avoid unnecessary costs. Categories such as ‘betting/lottery results’, ‘jobs and vacancies’ and ‘syndicate and arbitrage’ could be examples of queries not to show up for. This is also key when controlling search activity around branded queries.

7. Tracking, reporting and attribution

With online advertising in Sweden being predominantly display bought, one can assume that reporting is quite rudimentary with the focus largely concentrating on the cost of acquiring traffic. Google and Bing both opening their platforms for advertising will help add another measure in tracking last-click conversions.

Advertisers can now confidently track click to registration to first-time deposit and subsequent user activity. A robust and well-developed reporting system that integrates with Google will assist in making marketing operations smooth and efficient.

Activity was supposed to launch in January this year, but Google continues to delay matters and mid- May is rumoured to be the new start date. Most advertisers will have their accounts created and campaign building will have started. Tracking and internal data infrastructure, while more complex, should surely be well underway. Hopefully the above tips and considerations will bring success in the new market!