Away from the Portuguese behemoth, gaming in other parts of LatAm is also growing at an accelerated rate. Martin Calvert delves into some Spanish-speaking markets to identify their SEO growth and potential.

With the latest regulatory shifts, it’s unsurprising that Brazil is taking up a lot of the industry’s attention. However in this article we’ll focus in on some of the most intriguing markets in LatAm – Colombia, Mexico and Peru.

SEO is a dynamic field so (of course) this is only a snapshot but here we’ll look at some of the trends and methodologies that cut across all three nations, as well as some important points of difference.

In comparing some snapshot analysis of top performers in these three countries, the goal of this brief article is to identify not just potential opportunities and trends but restate some SEO best practices that marketers in all jurisdictions can benefit from.

The state of play

All three countries are at different stages of market growth. Colombia stands out as the first nation with full regulatory standards for gaming though it’s an evolving process. From initial regulation and opening of the market, focus has turned to critical matters like player protection, problem gambling and tax thresholds.

Mexico in contrast has a more ambiguous picture as while online operators are understood to only require partnership with land-based licence-holders, reviews of licences are ongoing. With the 2026 World Cup partly taking place in Mexico, we can expect a flurry of interest in online betting whether the legal quirks are ironed out by then or not.

Similarly, the situation in Peru is evolving, with firm plans for a new regulatory framework following the Ministry of Foreign Trade and Tourism (Mincetur) passing of Law No 31,557 to allow sportsbook and casino gambling. This should in time make rights and responsibilities clearer for bettors, affiliates and operators.

The common thread in all three countries is that regulation is still comparatively new and subject to change but nevertheless starting to give a picture of what the competitive landscape will entail for players, operator profits and the wider terms of engagement.

As a result, we can expect to see competition deepening, and international brands become more bullish about investing money into paid and organic marketing.

What this means is that from an SEO perspective, there will be a need to defend current rankings and be strategic about the ‘new’ rankings to pursue as part of a wider marketing mix.

Mexico

Looking at some of the current top performers in Mexico based on indicative SEMrush data, a few snapshot observations can be made:

Firstly, it's notable how top brands are battling it out for quite high-level terms such as ‘casino’ and ‘apuestas deportivas’ (sports betting). This, along with the not-inconsiderable cost per click for paid advertising, implies a level of maturity and development in the market in spite of the ‘ambiguous’ legal situation.

As the market regulates, new entrants won’t be dealing with a blank canvas but should have audiences of informed, experienced bettors to compete for - but also the presence of battle-hardened unregulated books who might find ways to go legit.

The challenge for some may be around more long-tail terms given the high level of competition already in the market.

Colombia

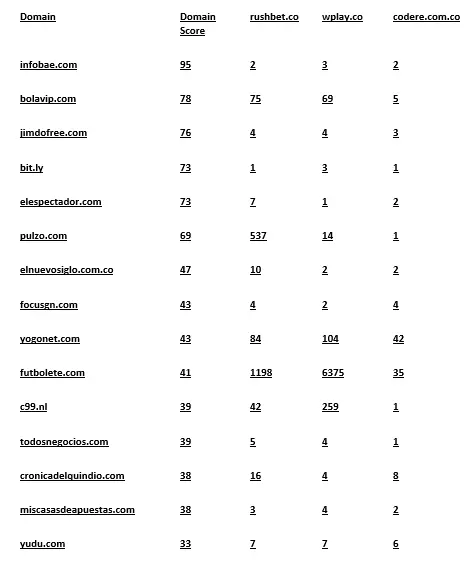

For Colombia, let’s take a look at some of the shared backlinks that top performers Rushbet, Wplay and Codere have.

Here it is worth noting that of the 5000 plus domains linking to these brands overall, they share links from almost 300 of them.

What this indicates for anyone new to the market is that there is an immediate block of publishers and sites that could be plausible targets for link building to establish a baseline in this SEO ‘neighbourhood’, but of course it pays to be discerning.

The other side of the picture of course is that there are 4,700 other sites that don’t link to all three of these top performers. A deeper analysis might reveal sites that are particularly interesting and strong as well as, I expect, some less relevant sites that might be providing little benefit.

The goal for those looking to compete more effectively in regulating and emerging markets like Colombia is to try and identify the quickest routes to get into a position of competitiveness. This can be done by retracing the steps of those who have gone before.

Stopping there is not enough though - to become a key player, a robust approach to unique, powerful and topically relevant links is key.

In a newly regulated market, they may be hard to come by but that is why it’s important to consider strategies like acquiring links on international sites. For example this could utilising Colombian traffic and perhaps devoting extra time to the mainstream media publishers with the strongest sites, but with perhaps weaker topical relevance.

As the market grows and matures, snapping up opportunities for prime placements with domestic, native-language sites with higher relevance is key. For smaller, faster and more agile firms, this could be an area of competitive advantage.

Peru

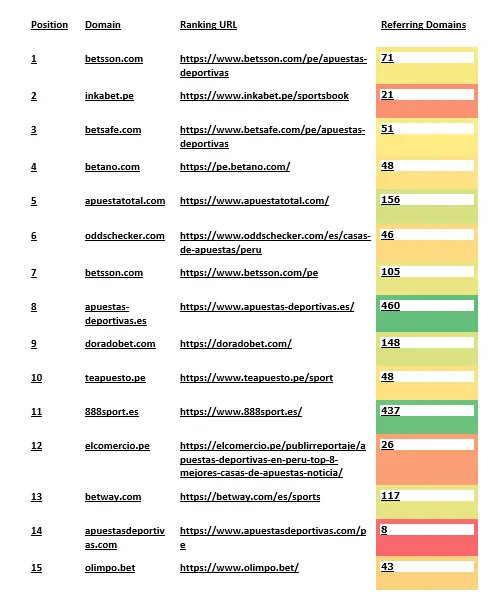

For Peru, let’s take a look at the sites that are ranking for the keyword that almost seems to define the SEO opportunity in LatAm: ‘apuestas deportivas’

Firstly, it’s worth considering the spread of sites here and the presence of strong international brands with a razor-sharp approach to SEO. For major keywords like ‘apuestas deportivas’ you can be sure that even in evolving markets, sizable players will already have a strategy in mind.

Looking at these 15 sites it appears that there isn’t a correlation in top performance compared to the number of referring domains, but that’s not to say the quality of linking domains isn’t worth exploring.

As ever, in the rush to capitalise on the opportunities of a newly regulated market, it isn’t unusual for firms to overspend on link acquisition methods that won’t move the dial.

Though there are clearly some big names ranking for this term in Peru, the scale of the challenge in off-site SEO terms doesn’t seem enormous. This might encourage smaller brands or tactical affiliates to start gunning for major keywords rather than long-tail, informational queries.

However, this is an evolving market and as regulation comes into force, that’s when the competition might really begin.

For now though? There’s plenty of inspiration based on the type of content that is ranking, as well as the off-site dimension.

Summing up

By using snapshot analysis from these three emerging markets, it’s possible not only to identify some starting points for SEO strategy within these countries but also to remind ourselves of SEO fundamentals that apply to any market and industry.

That is to say, a pragmatic focus on assessing the scale of competition, identifying the quantity and quality of SEO initiatives required to meaningfully compete and the necessary blend of onsite and offsite methodologies required to form a sustainable strategy.

At ICS we’ll be watching closely as these markets heat up, and how the competitive picture may change but the SEO basics will continue to be a factor in who comes out on top, particularly as (some) brands have learned costly lessons from over-indulgent paid media strategies in markets like the US.

Martin Calvert

is marketing director for ICS-digital and ICS-translate. The sister agencies work globally across multilingual SEO, content, digital PR and translation with a core focus on highly regulated industries.