Germany recently approved regulations to expand its online gambling market, but by setting out such restrictive operating conditions, it risks making the same mistakes as Sweden, writes Fintan Costello

On 12 March, German lawmakers approved regulations to legalise online poker and casino from 1 July 2021. But in implementing a restrictive model under which slots will be subject to a €1 per spin stake limit with no autoplay and no jackpots, and requiring these to be offered separately to table games, they risk sending huge numbers of players to unlicensed sites that offer no such restrictions. They didn’t get to this decision alone. On 1 January 2019, close neighbour Sweden accidentally created a vast black market of its own, one that is now spiralling out of control. Without urgent action, the situation in Germany has the potential to be far worse. The Nordic markets were once a key driver of European dot.com growth, but then Sweden decided to regulate. Everything seemed rosy at first, with operators and suppliers primed with pre-approved licences and ready-to-go compliance strategies. However, reality began to bite when a series of factors collided to hamper the market from day one: rising costs due to tax and regulation, local monopolies allowed to expand product portfolios, and marketing measures restricting brands to only offering a single first-time welcome bonus (and being severely punished if they stepped out of line). As Gustaf Hoffstedt, from Sweden’s online gambling trade body BOS, argued earlier this year, there is strong evidence pointing towards thousands of players “leaking” through the government’s channelisation strategy and into the hands of unlicensed black-market operators.

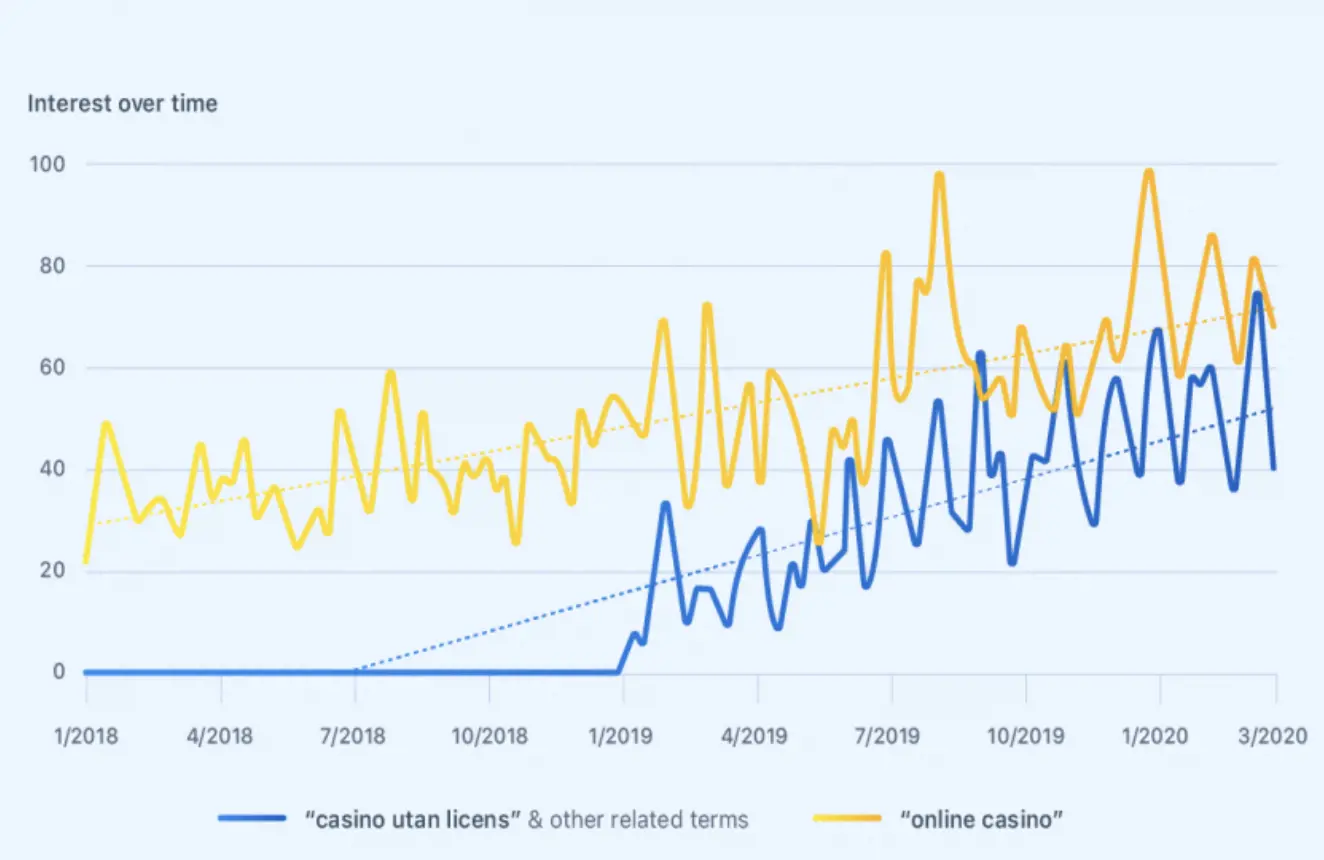

Even more worrying is that the situation appears to be getting worse, with Ardalan Shekarabi, Sweden’s Minister of Social Security and a key player in drafting the country’s online gambling framework, unwilling to clamp down on those flouting the rules outside the legal framework. Instead he is pressing ahead with enforcing tougher sanctions, not to mention advertising and marketing restrictions. Figures vary but according to official Swedish Gaming Authority numbers, 91% of gambling is carried out by licensed operators in a market worth more than €1.2bn. In November 2019, H2 Gambling Capital estimated channelisation to be at approximately 85% to 87%, but based on our data that trend has continued, and we estimate the proportion of Swedish players using illegal black-market casinos to be closer to 70%. Our numbers show this problem is deepening with potentially vulnerable players left unprotected and open to market abuse. Using publicly available data from Google Trends we found huge growth in searches taking place in Sweden for a basket of terms including ‘casino utan licens’ (unlicensed casino), when compared to ‘online casino’, reinforcing the theory that aggressive restrictions for licensed operators are driving players to search for, and convert to, playing on unlicensed brands: